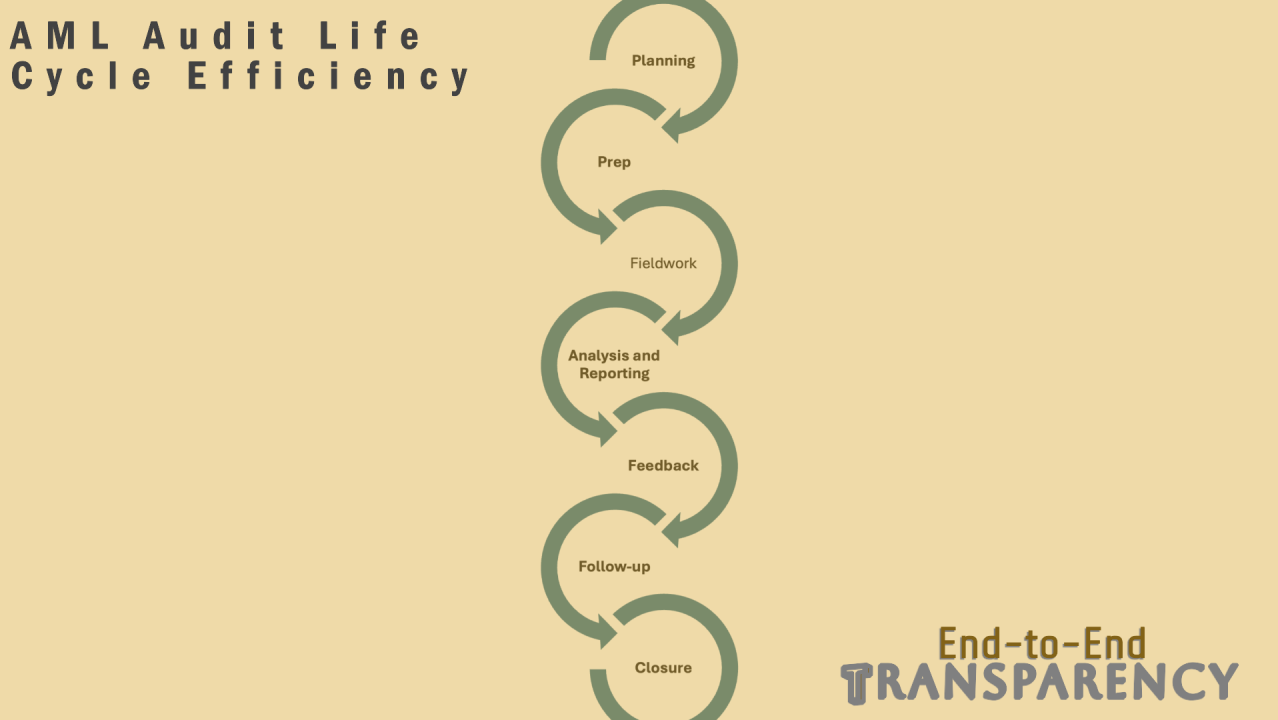

Financial Institutions often struggle to understand the Financial Crime Audit Process. Why can't it be consistent and efficient? The AML audit life cycle is a structured process designed to assess the effectiveness of an organization's Anti-Money Laundering (AML) program. The life cycle ensures compliance with applicable regulations, identifies control gaps, and evaluates risk management practices. Setting expectations and allowing for transparency throughout the process is critical when conducting AML audits. We all must remember that auditors are part of the process to add value and not to point fingers. Here's an overview of the typical stages in an AML audit life cycle:

Phase 1: Planning

Define Scope and Objective: determine which areas of the AML program will be reviewed (e.g., Transaction Monitoring (TM), KYC, sanctions screening).

Activities:

Scope, objective, risk assessment, resource allocation, regulatory review, plan, and issue memo.

Audit Deliverables:

Audit memo with scope statement

Introduction meeting minutes

Document storage decision communication

Phase 2: Prep

Collect Data, Conduct Preliminary Analysis, and Kickoff Meetings: request relevant policies and procedures review past audit reports, engage with stakeholders, and discuss objectives, timelines, and expectations.

Activities:

Data collection, initial analysis, kickoff meeting

Audit Deliverables:

Clarified scope statement

Agreed on artifacts and deliverables schedules

Agreed risk rating methodology

Audit RACI

Meeting cadence

Phase 3: Fieldwork

Testing Controls: Evaluate the effectiveness of controls in areas like transaction monitoring, CTRs, SAR filings, KYC/CDD, and sanctions screening.

Activities:

Test controls, sample testing, interviews and observations, system validation, and regulatory compliance review.

Audit Deliverables:

Observations memos

Gaps tracker

Documents request tracker

Weekly reposts

Monthly status reports

Documented exceptions or agreements for audit

Phase 4: Analysis and Reporting

Conduct Gap Analysis, Assign Risk Rating, Make Recommendations, and Draft Report: Identify weaknesses, deficiencies, and non-compliance issues, and assign risk levels based on impact on the organization. Make actionable recommendations to address issues, mitigate risk, and prepare a detailed draft report.

Activities:

Review risk and control matrix and taxonomies, review artifacts and updated documentation if applicable, and review mitigation status for issues previously identified.

Audit Deliverables:

Findings list

Draft report

Final draft

Phase 5: Feedback

Share the Initial Draft Report, Incorporating Feedback: Share reports with stakeholders, incorporate feedback, and submit the audit final report to senior management and the board, as well as regulators, if necessary.

Activities:

Stakeholder review, report updates with action plans, submission, and sharing the final report

Audit Deliverables:

Final report review mtg. mins.

Updated final report with action plans and final risk ratings

Phase 6: Follow-up

Monitor Action Plans, Ensure Continuous Improvements, and Conduct Re-Audits if Necessary: track mitigation plan timelines, review corrective actions, and conduct re-audits or lookbacks to verify that issues have been resolved. Use audit findings to refine AML policies, procedures, and controls.

Activities:

Action plan monitoring, re-audit, and continuous improvements

Audit Deliverables:

Re-audit reports if applicable

Updated action plans

Phase 7: Closure

Finalize and archive documentation and document and share Lessons Learned: archive audit report, work papers, and supporting documentation for regulatory review and future reference. Document lessons learned to improve AML processes.

Activities:

Update and archive final documentation, share lessons learned, conduct a functional impact analysis of issues identified, and report findings.

Audit Deliverables:

Lessons learned document

Impact analysis based on audit findings

Summary

The AML audit life cycle should be iterative, ensuring controls are continually monitored, enhanced, and aligned to evolving financial crime risks and regulatory expectations. The process should be transparent and effective. The table below summarizes activities for each phase of the AML audit life cycle, This includes commonly reviewed scope, reviewed artifacts, audit team deliverables, and some common tools useful to auditors. An Audit Manager should have strong project management skills. The Planning and Prep phases are crucial to ensuring AML audits run effectively and expectations are set accordingly.

Published on Dec. 13, 2024

Author: Denise Mejia

Support@potestassolutions.com